Page 193 - SBR Integrated Workbook STUDENT S18-J19

P. 193

Financial instruments

IFRS 9 says the gains and losses recognised in other comprehensive income are

recycled into the statement of profit or loss if the hedged transaction results in

the recognition of a financial asset (e.g. cash)

adjusted against the carrying amount of the asset recognised if it is a non-

financial asset (e.g. inventory or PPE).

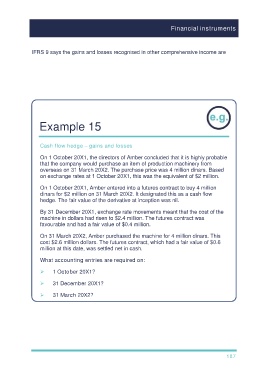

Example 15

Cash flow hedge – gains and losses

On 1 October 20X1, the directors of Amber concluded that it is highly probable

that the company would purchase an item of production machinery from

overseas on 31 March 20X2. The purchase price was 4 million dinars. Based

on exchange rates at 1 October 20X1, this was the equivalent of $2 million.

On 1 October 20X1, Amber entered into a futures contract to buy 4 million

dinars for $2 million on 31 March 20X2. It designated this as a cash flow

hedge. The fair value of the derivative at inception was nil.

By 31 December 20X1, exchange rate movements meant that the cost of the

machine in dollars had risen to $2.4 million. The futures contract was

favourable and had a fair value of $0.4 million.

On 31 March 20X2, Amber purchased the machine for 4 million dinars. This

cost $2.6 million dollars. The futures contract, which had a fair value of $0.6

million at this date, was settled net in cash.

What accounting entries are required on:

1 October 20X1?

31 December 20X1?

31 March 20X2?

187