Page 294 - SBR Integrated Workbook STUDENT S18-J19

P. 294

Chapter 19

2.3 Presentation of disposals in consolidated financial statements

There are two ways of presenting the results of the disposed subsidiary:

If it does not meet the definition of a discontinued operation then time apportion

its results line-by-line, and present the profit/loss on disposal as an exceptional

item in arriving at profit before tax.

Present a single figure – profit from discontinued operations. This is

comprised of:

– the subsidiary’s profit pro-rated up to disposal

– the profit or loss on disposal.

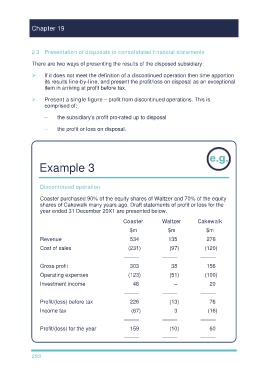

Example 3

Discontinued operation

Coaster purchased 90% of the equity shares of Waltzer and 70% of the equity

shares of Cakewalk many years ago. Draft statements of profit or loss for the

year ended 31 December 20X1 are presented below.

Coaster Waltzer Cakewalk

$m $m $m

Revenue 534 135 276

Cost of sales (231) (97) (120)

––––– ––––– –––––

Gross profit 303 38 156

Operating expenses (123) (51) (100)

Investment income 46 – 20

––––– ––––– –––––

Profit/(loss) before tax 226 (13) 76

Income tax (67) 3 (16)

––––– ––––– –––––

Profit/(loss) for the year 159 (10) 60

––––– ––––– –––––

288