Page 130 - Microsoft Word - 00 P1 IW Prelims.docx

P. 130

Chapter 8

The Black-Scholes Option Pricing

(BSOP) model

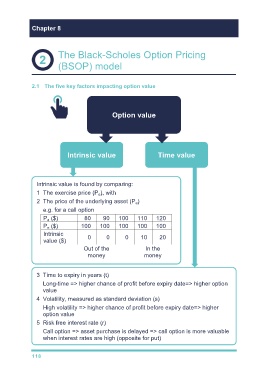

2.1 The five key factors impacting option value

Option value

Intrinsic value Time value

Intrinsic value is found by comparing:

1 The exercise price (P ), with

e

2 The price of the underlying asset (P )

a

e.g. for a call option

P a ($) 80 90 100 110 120

P e ($) 100 100 100 100 100

Intrinsic

0 0 0 10 20

value ($)

Out of the In the

money money

3 Time to expiry in years (t)

Long-time => higher chance of profit before expiry date=> higher option

value

4 Volatility, measured as standard deviation (s)

High volatility => higher chance of profit before expiry date=> higher

option value

5 Risk free interest rate (r)

Call option => asset purchase is delayed => call option is more valuable

when interest rates are high (opposite for put)

118