Page 204 - Microsoft Word - 00 P1 IW Prelims.docx

P. 204

Chapter 12

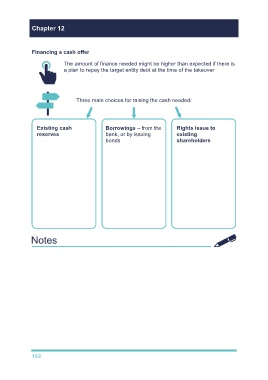

Financing a cash offer

The amount of finance needed might be higher than expected if there is

a plan to repay the target entity debt at the time of the takeover. This

can sometimes be a requirement of the target entity's lenders, as

stipulated in a debt covenant.

Three main choices for raising the cash needed:

Existing cash Borrowings – from the Rights issue to

reserves – can only bank, or by issuing existing

be used if the bidder bonds shareholders

has a large cash

surplus. Advantage – low cost Advantage – gearing

of servicing the debt. is not affected,

although its earnings

Disadvantage – per share will fall as

increase in the bidding new shares are

company's gearing. issued.

Disadvantage – it is

the shareholders

themselves who have

to find the money to

invest.

192