Page 215 - Microsoft Word - 00 P1 IW Prelims.docx

P. 215

Business valuation

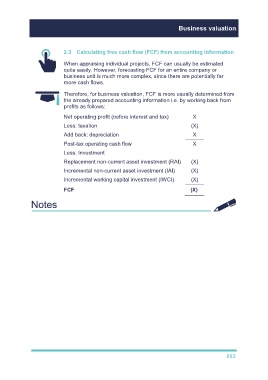

2.3 Calculating free cash flow (FCF) from accounting information

When appraising individual projects, FCF can usually be estimated

quite easily. However, forecasting FCF for an entire company or

business unit is much more complex, since there are potentially far

more cash flows.

Therefore, for business valuation, FCF is more usually determined from

the already prepared accounting information i.e. by working back from

profits as follows:

Net operating profit (before interest and tax) X

Less: taxation (X)

Add back: depreciation X

Post-tax operating cash flow X

Less: Investment

Replacement non-current asset investment (RAI) (X)

Incremental non-current asset investment (IAI) (X)

Incremental working capital investment (IWCI) (X)

FCF (X)

203