Page 32 - Microsoft Word - 00 P1 IW Prelims.docx

P. 32

Chapter 2

Internal rate of return (IRR) and

modified internal rate of return (MIRR)

3.1 Introduction to IRR

The IRR is the discount rate at which the project has a zero NPV.

Therefore IRR is particularly useful when trying to assess the sensitivity of the NPV

to changes in the cost of capital.

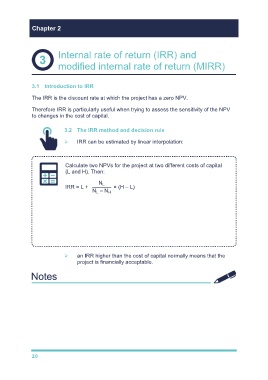

3.2 The IRR method and decision rule

IRR can be estimated by linear interpolation:

Calculate two NPVs for the project at two different costs of capital

(L and H). Then:

N L

IRR = L + × (H – L)

N – N H

L

Where L = Lower rate of interest

H = Higher rate of interest

N L = NPV at the lower rate of interest

N H = NPV at higher rate of interest

an IRR higher than the cost of capital normally means that the

project is financially acceptable.

20