Page 27 - PowerPoint Presentation

P. 27

COMPLEX GROUPS

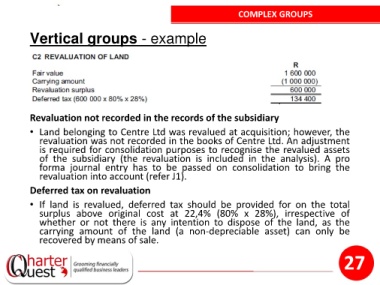

Vertical groups - example

Revaluation not recorded in the records of the subsidiary

• Land belonging to Centre Ltd was revalued at acquisition; however, the

revaluation was not recorded in the books of Centre Ltd. An adjustment

is required for consolidation purposes to recognise the revalued assets

of the subsidiary (the revaluation is included in the analysis). A pro

forma journal entry has to be passed on consolidation to bring the

revaluation into account (refer J1).

Deferred tax on revaluation

• If land is revalued, deferred tax should be provided for on the total

surplus above original cost at 22,4% (80% x 28%), irrespective of

whether or not there is any intention to dispose of the land, as the

carrying amount of the land (a non-depreciable asset) can only be

recovered by means of sale.

27