Page 51 - FINAL CFA I SLIDES JUNE 2019 DAY 8

P. 51

Session Unit 8:

30. Income Taxes, p.259

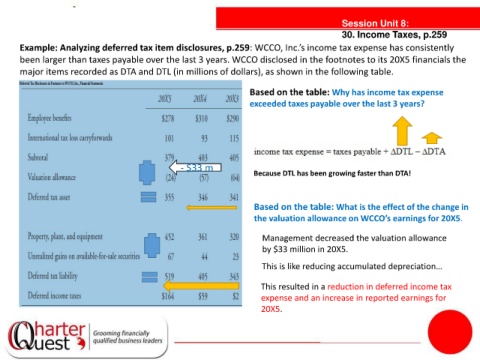

Example: Analyzing deferred tax item disclosures, p.259: WCCO, Inc.’s income tax expense has consistently

been larger than taxes payable over the last 3 years. WCCO disclosed in the footnotes to its 20X5 financials the

major items recorded as DTA and DTL (in millions of dollars), as shown in the following table.

Based on the table: Why has income tax expense

exceeded taxes payable over the last 3 years?

tanties

- $33 m

Because DTL has been growing faster than DTA!

Based on the table: What is the effect of the change in

the valuation allowance on WCCO’s earnings for 20X5.

Management decreased the valuation allowance

by $33 million in 20X5.

This is like reducing accumulated depreciation…

This resulted in a reduction in deferred income tax

expense and an increase in reported earnings for

20X5.