Page 20 - Taxation F6 - Income From Employment

P. 20

Income from Employment

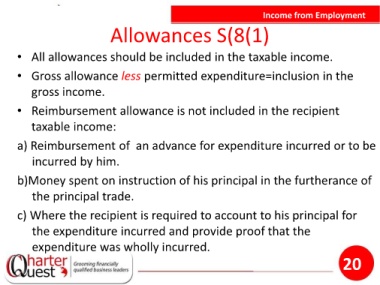

Allowances S(8(1)

• All allowances should be included in the taxable income.

• Gross allowance less permitted expenditure=inclusion in the

gross income.

• Reimbursement allowance is not included in the recipient

taxable income:

a) Reimbursement of an advance for expenditure incurred or to be

incurred by him.

b)Money spent on instruction of his principal in the furtherance of

the principal trade.

c) Where the recipient is required to account to his principal for

the expenditure incurred and provide proof that the

expenditure was wholly incurred.

20