Page 26 - Taxation F6 - Income From Employment

P. 26

Income from Employment

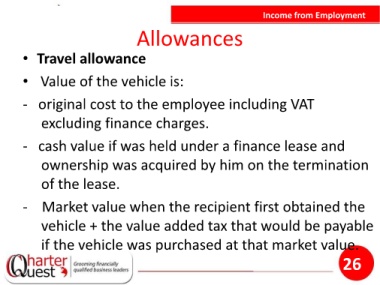

Allowances

• Travel allowance

• Value of the vehicle is:

- original cost to the employee including VAT

excluding finance charges.

- cash value if was held under a finance lease and

ownership was acquired by him on the termination

of the lease.

- Market value when the recipient first obtained the

vehicle + the value added tax that would be payable

if the vehicle was purchased at that market value.

26