Page 35 - Taxation F6 - Income From Employment

P. 35

Income from Employment

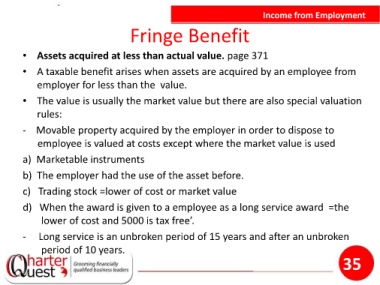

Fringe Benefit

• Assets acquired at less than actual value. page 371

• A taxable benefit arises when assets are acquired by an employee from

employer for less than the value.

• The value is usually the market value but there are also special valuation

rules:

- Movable property acquired by the employer in order to dispose to

employee is valued at costs except where the market value is used

a) Marketable instruments

b) The employer had the use of the asset before.

c) Trading stock =lower of cost or market value

d) When the award is given to a employee as a long service award =the

lower of cost and 5000 is tax free’.

- Long service is an unbroken period of 15 years and after an unbroken

period of 10 years.

35