Page 12 - FINAL CFA SLIDES DECEMBER 2018 DAY 7

P. 12

Session Unit 6:

22. Financial Reporting Mechanics, p.12

LOS 22d: Describe the process of recording business transactions using an accounting system

based on the accounting equation, p13

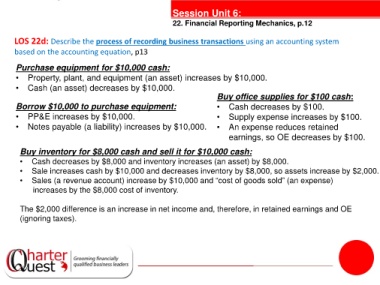

Purchase equipment for $10,000 cash:

• Property, plant, and equipment (an asset) increases by $10,000.

• Cash (an asset) decreases by $10,000.

Buy office supplies for $100 cash:

Borrow $10,000 to purchase equipment: • Cash decreases by $100.

• PP&E increases by $10,000. • Supply expense increases by $100.

• Notes payable (a liability) increases by $10,000. • An expense reduces retained

earnings, so OE decreases by $100.

Buy inventory for $8,000 cash and sell it for $10,000 cash:

• Cash decreases by $8,000 and inventory increases (an asset) by $8,000.

• Sale increases cash by $10,000 and decreases inventory by $8,000, so assets increase by $2,000.

• Sales (a revenue account) increase by $10,000 and “cost of goods sold” (an expense)

increases by the $8,000 cost of inventory.

The $2,000 difference is an increase in net income and, therefore, in retained earnings and OE

(ignoring taxes).