Page 30 - FINAL CFA SLIDES DECEMBER 2018 DAY 7

P. 30

Session Unit 6:

23. Financial Reporting Standards

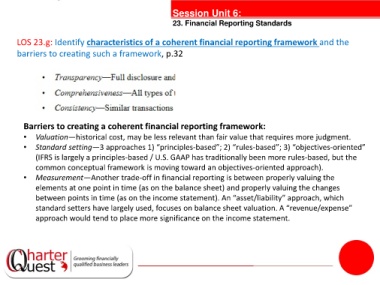

LOS 23.g: Identify characteristics of a coherent financial reporting framework and the

barriers to creating such a framework, p.32

Barriers to creating a coherent financial reporting framework:

• Valuation—historical cost, may be less relevant than fair value that requires more judgment.

• Standard setting—3 approaches 1) “principles-based”; 2) “rules-based”; 3) “objectives-oriented”

(IFRS is largely a principles-based / U.S. GAAP has traditionally been more rules-based, but the

common conceptual framework is moving toward an objectives-oriented approach).

• Measurement—Another trade-off in financial reporting is between properly valuing the

elements at one point in time (as on the balance sheet) and properly valuing the changes

between points in time (as on the income statement). An “asset/liability” approach, which

standard setters have largely used, focuses on balance sheet valuation. A “revenue/expense”

approach would tend to place more significance on the income statement.