Page 10 - FINAL CFA II SLIDES JUNE 2019 DAY 2

P. 10

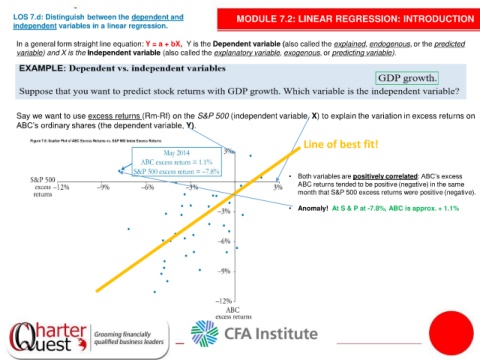

LOS 7.d: Distinguish between the dependent and MODULE 7.2: LINEAR REGRESSION: INTRODUCTION

independent variables in a linear regression.

In a general form straight line equation: Y = a + bX, Y is the Dependent variable (also called the explained, endogenous, or the predicted

variable) and X is the Independent variable (also called the explanatory variable, exogenous, or predicting variable).

Say we want to use excess returns (Rm-Rf) on the S&P 500 (independent variable, X) to explain the variation in excess returns on

ABC’s ordinary shares (the dependent variable, Y).

Line of best fit!

• Both variables are positively correlated: ABC’s excess

ABC returns tended to be positive (negative) in the same

month that S&P 500 excess returns were positive (negative).

• Anomaly! At S & P at -7.8%, ABC is approx. + 1.1%