Page 116 - ADVANCED TAXATION - Day 1 Slides

P. 116

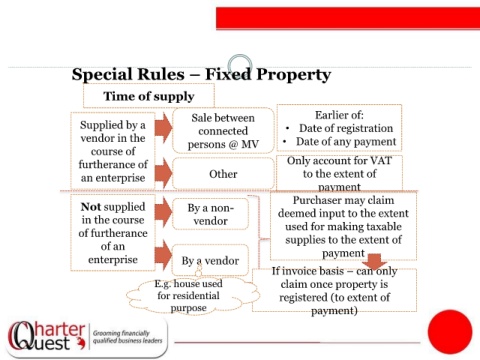

Special Rules – Fixed Property

Time of supply

Sale between Earlier of:

Supplied by a connected • Date of registration

vendor in the persons @ MV • Date of any payment

course of

furtherance of Only account for VAT

an enterprise Other to the extent of

payment

Purchaser may claim

Not supplied By a non- deemed input to the extent

in the course vendor

of furtherance used for making taxable

supplies to the extent of

of an

enterprise By a vendor payment

If invoice basis – can only

E.g. house used claim once property is

for residential registered (to extent of

purpose payment)