Page 126 - ADVANCED TAXATION - Day 1 Slides

P. 126

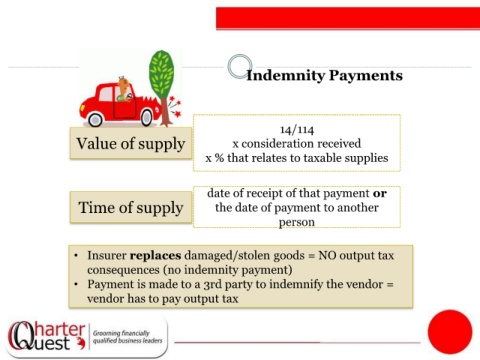

Deemed Supply:

Indemnity Payments

14/114

Value of supply x consideration received

x % that relates to taxable supplies

date of receipt of that payment or

Time of supply the date of payment to another

person

• Insurer replaces damaged/stolen goods = NO output tax

consequences (no indemnity payment)

• Payment is made to a 3rd party to indemnify the vendor =

vendor has to pay output tax