Page 47 - ADVANCED TAXATION - Day 1 Slides

P. 47

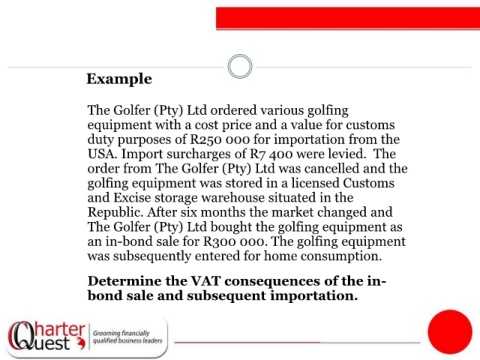

Example

The Golfer (Pty) Ltd ordered various golfing

equipment with a cost price and a value for customs

duty purposes of R250 000 for importation from the

USA. Import surcharges of R7 400 were levied. The

order from The Golfer (Pty) Ltd was cancelled and the

golfing equipment was stored in a licensed Customs

and Excise storage warehouse situated in the

Republic. After six months the market changed and

The Golfer (Pty) Ltd bought the golfing equipment as

an in-bond sale for R300 000. The golfing equipment

was subsequently entered for home consumption.

Determine the VAT consequences of the in-

bond sale and subsequent importation.