Page 8 - ADVANCED TAXATION - Day 1 Slides

P. 8

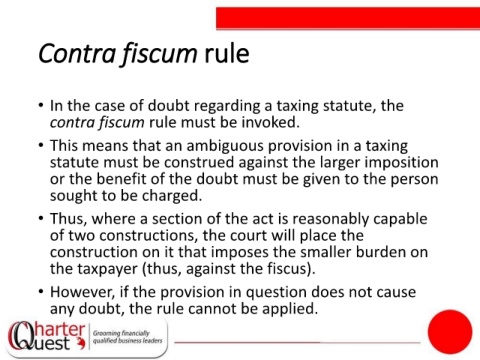

Contra fiscum rule

• In the case of doubt regarding a taxing statute, the

contra fiscum rule must be invoked.

• This means that an ambiguous provision in a taxing

statute must be construed against the larger imposition

or the benefit of the doubt must be given to the person

sought to be charged.

• Thus, where a section of the act is reasonably capable

of two constructions, the court will place the

construction on it that imposes the smaller burden on

the taxpayer (thus, against the fiscus).

• However, if the provision in question does not cause

any doubt, the rule cannot be applied.