Page 90 - ADVANCED TAXATION - Day 1 Slides

P. 90

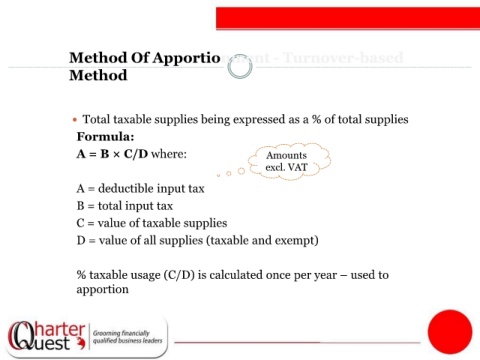

Method Of Apportionment - Turnover-based

Method

Total taxable supplies being expressed as a % of total supplies

Formula:

A = B × C/D where: Amounts

excl. VAT

A = deductible input tax

B = total input tax

C = value of taxable supplies

D = value of all supplies (taxable and exempt)

% taxable usage (C/D) is calculated once per year – used to

apportion