Page 22 - Finac2 Test 1 Slides - 3. Intra-Group Transactions

P. 22

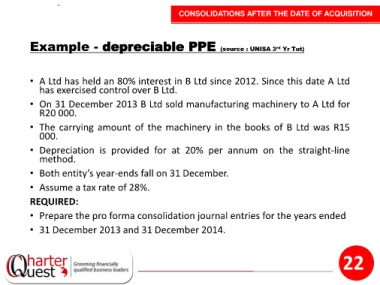

CONSOLIDATIONS AFTER THE DATE OF ACQUISITION

Example - depreciable PPE (source : UNISA 3 rd Yr Tut)

• A Ltd has held an 80% interest in B Ltd since 2012. Since this date A Ltd

has exercised control over B Ltd.

• On 31 December 2013 B Ltd sold manufacturing machinery to A Ltd for

R20 000.

• The carrying amount of the machinery in the books of B Ltd was R15

000.

• Depreciation is provided for at 20% per annum on the straight-line

method.

• Both entity’s year-ends fall on 31 December.

• Assume a tax rate of 28%.

REQUIRED:

• Prepare the pro forma consolidation journal entries for the years ended

• 31 December 2013 and 31 December 2014.

22