Page 73 - Finac2 Test 1 Slides - 3. Intra-Group Transactions

P. 73

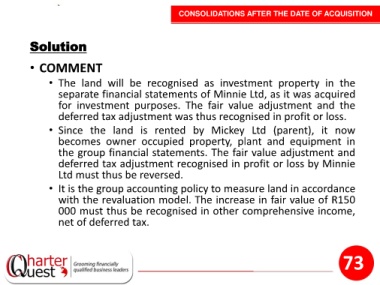

CONSOLIDATIONS AFTER THE DATE OF ACQUISITION

Solution

• COMMENT

• The land will be recognised as investment property in the

separate financial statements of Minnie Ltd, as it was acquired

for investment purposes. The fair value adjustment and the

deferred tax adjustment was thus recognised in profit or loss.

• Since the land is rented by Mickey Ltd (parent), it now

becomes owner occupied property, plant and equipment in

the group financial statements. The fair value adjustment and

deferred tax adjustment recognised in profit or loss by Minnie

Ltd must thus be reversed.

• It is the group accounting policy to measure land in accordance

with the revaluation model. The increase in fair value of R150

000 must thus be recognised in other comprehensive income,

net of deferred tax.

73