Page 6 - Trusts & International tax class slides

P. 6

INTERNATIONAL TAXATION

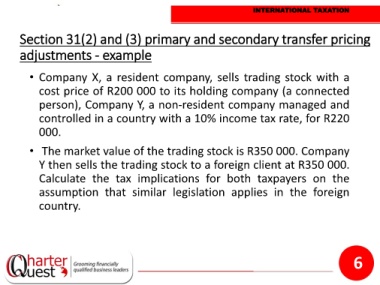

Section 31(2) and (3) primary and secondary transfer pricing

adjustments - example

• Company X, a resident company, sells trading stock with a

cost price of R200 000 to its holding company (a connected

person), Company Y, a non-resident company managed and

controlled in a country with a 10% income tax rate, for R220

000.

• The market value of the trading stock is R350 000. Company

Y then sells the trading stock to a foreign client at R350 000.

Calculate the tax implications for both taxpayers on the

assumption that similar legislation applies in the foreign

country.

6