Page 109 - SAICA Tax Day 2 Slides

P. 109

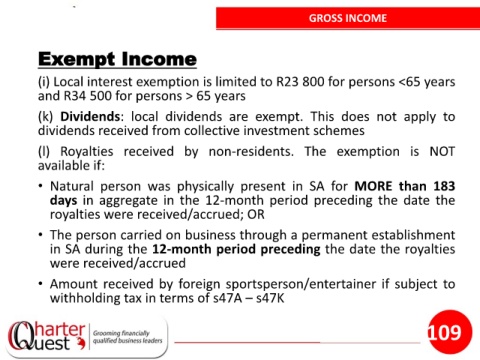

GROSS INCOME

Exempt Income

(i) Local interest exemption is limited to R23 800 for persons <65 years

and R34 500 for persons > 65 years

(k) Dividends: local dividends are exempt. This does not apply to

dividends received from collective investment schemes

(l) Royalties received by non-residents. The exemption is NOT

available if:

• Natural person was physically present in SA for MORE than 183

days in aggregate in the 12-month period preceding the date the

royalties were received/accrued; OR

• The person carried on business through a permanent establishment

in SA during the 12-month period preceding the date the royalties

were received/accrued

• Amount received by foreign sportsperson/entertainer if subject to

withholding tax in terms of s47A – s47K

109