Page 93 - SAICA Tax Day 2 Slides

P. 93

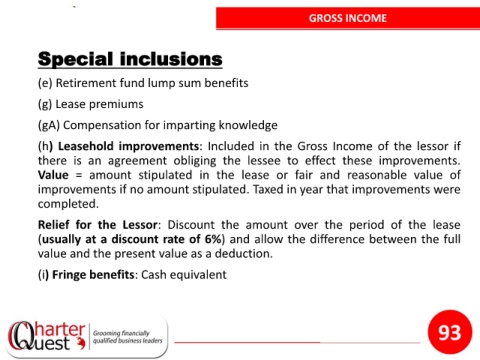

GROSS INCOME

Special inclusions

(e) Retirement fund lump sum benefits

(g) Lease premiums

(gA) Compensation for imparting knowledge

(h) Leasehold improvements: Included in the Gross Income of the lessor if

there is an agreement obliging the lessee to effect these improvements.

Value = amount stipulated in the lease or fair and reasonable value of

improvements if no amount stipulated. Taxed in year that improvements were

completed.

Relief for the Lessor: Discount the amount over the period of the lease

(usually at a discount rate of 6%) and allow the difference between the full

value and the present value as a deduction.

(i) Fringe benefits: Cash equivalent

93