Page 3 - P6 Slide Taxation - Lecture Day 5 - Foreign Exchange

P. 3

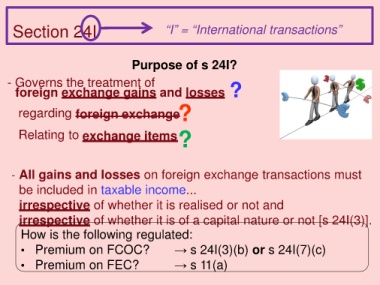

Section 24I “I” = “International transactions”

Purpose of s 24I?

- Governs the treatment of

foreign exchange gains and losses ?

regarding foreign exchange ?

Relating to exchange items ?

- All gains and losses on foreign exchange transactions must

be included in taxable income...

irrespective of whether it is realised or not and

irrespective of whether it is of a capital nature or not [s 24I(3)].

How is the following regulated:

• Premium on FCOC? → s 24I(3)(b) or s 24I(7)(c)

• Premium on FEC? → s 11(a)