Page 2 - 5.3 i. Taxation ITC Summarised Notes part 3

P. 2

ITC EXAM PREP

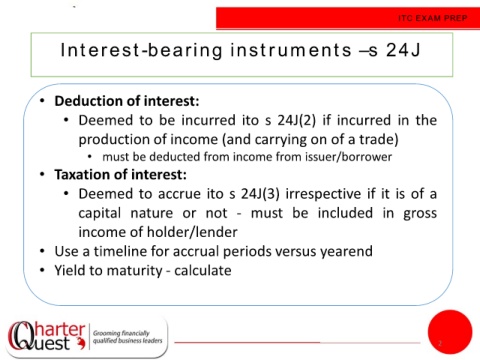

Interest-bearing instruments –s 24J

• Deduction of interest:

• Deemed to be incurred ito s 24J(2) if incurred in the

production of income (and carrying on of a trade)

• must be deducted from income from issuer/borrower

• Taxation of interest:

• Deemed to accrue ito s 24J(3) irrespective if it is of a

capital nature or not - must be included in gross

income of holder/lender

• Use a timeline for accrual periods versus yearend

• Yield to maturity - calculate

2