Page 34 - Finac1 Test 1 slides - 5. Income Taxes (IAS 12)

P. 34

INCOME TAXES

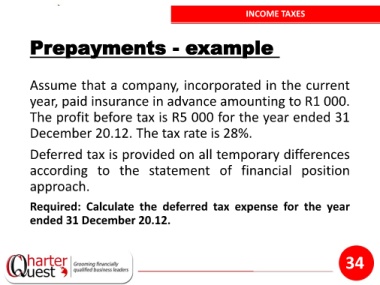

Prepayments - example

Assume that a company, incorporated in the current

year, paid insurance in advance amounting to R1 000.

The profit before tax is R5 000 for the year ended 31

December 20.12. The tax rate is 28%.

Deferred tax is provided on all temporary differences

according to the statement of financial position

approach.

Required: Calculate the deferred tax expense for the year

ended 31 December 20.12.

34