Page 16 - F6 - Capital Allowances - Movable & Immovable Assets

P. 16

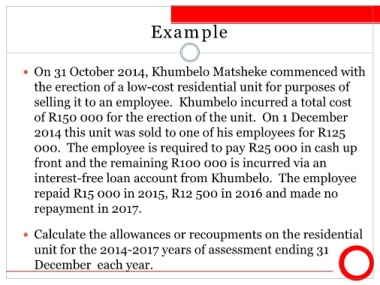

Example

On 31 October 2014, Khumbelo Matsheke commenced with

the erection of a low-cost residential unit for purposes of

selling it to an employee. Khumbelo incurred a total cost

of R150 000 for the erection of the unit. On 1 December

2014 this unit was sold to one of his employees for R125

000. The employee is required to pay R25 000 in cash up

front and the remaining R100 000 is incurred via an

interest-free loan account from Khumbelo. The employee

repaid R15 000 in 2015, R12 500 in 2016 and made no

repayment in 2017.

Calculate the allowances or recoupments on the residential

unit for the 2014-2017 years of assessment ending 31

December each year.