Page 44 - FINAL CFA SLIDES DECEMBER 2018 DAY 15

P. 44

Session Unit 16:

55. Fundamentals of Credit Analysis

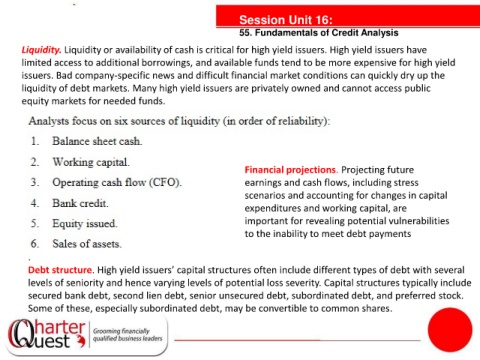

Liquidity. Liquidity or availability of cash is critical for high yield issuers. High yield issuers have

limited access to additional borrowings, and available funds tend to be more expensive for high yield

issuers. Bad company-specific news and difficult financial market conditions can quickly dry up the

liquidity of debt markets. Many high yield issuers are privately owned and cannot access public

equity markets for needed funds.

tanties

Financial projections. Projecting future

earnings and cash flows, including stress

scenarios and accounting for changes in capital

expenditures and working capital, are

important for revealing potential vulnerabilities

to the inability to meet debt payments

.

Debt structure. High yield issuers’ capital structures often include different types of debt with several

levels of seniority and hence varying levels of potential loss severity. Capital structures typically include

secured bank debt, second lien debt, senior unsecured debt, subordinated debt, and preferred stock.

Some of these, especially subordinated debt, may be convertible to common shares.