Page 19 - FINAL CFA II SLIDES JUNE 2019 DAY 6

P. 19

Costs of asymmetric information: Managers have inside READING 21: CAPITAL STRUCTURE

info than owners or creditors; these stakeholders then look

for management behavior that “signals” what knowledge

management may have: MODULE 21.2: FACTORS AFFECTING CAPITAL STRUCTURE

• Choice of debt sends a signal that management has confidence in the firm’s ability to make these payments in the future.

• Issuing equity is typically viewed as a negative signal that managers believe a firm’s stock is overvalued.

The cost of asymmetric information increases as the proportion of equity in the capital structure increases.

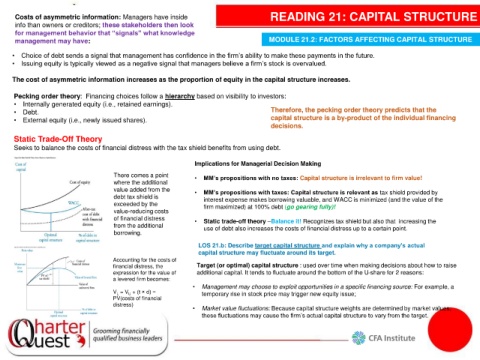

Pecking order theory: Financing choices follow a hierarchy based on visibility to investors:

• Internally generated equity (i.e., retained earnings).

• Debt. Therefore, the pecking order theory predicts that the

• External equity (i.e., newly issued shares). capital structure is a by-product of the individual financing

decisions.

Static Trade-Off Theory

Seeks to balance the costs of financial distress with the tax shield benefits from using debt.

Implications for Managerial Decision Making

There comes a point • MM’s propositions with no taxes: Capital structure is irrelevant to firm value!

where the additional

value added from the • MM’s propositions with taxes: Capital structure is relevant as tax shield provided by

debt tax shield is interest expense makes borrowing valuable, and WACC is minimized (and the value of the

exceeded by the firm maximized) at 100% debt (go gearing fully)!

value-reducing costs

of financial distress • Static trade-off theory –Balance it! Recognizes tax shield but also that increasing the

from the additional use of debt also increases the costs of financial distress up to a certain point.

borrowing.

LOS 21.b: Describe target capital structure and explain why a company’s actual

capital structure may fluctuate around its target.

Accounting for the costs of

financial distress, the Target (or optimal) capital structure : used over time when making decisions about how to raise

expression for the value of additional capital. It tends to fluctuate around the bottom of the U-share for 2 reasons:

a levered firm becomes:

• Management may choose to exploit opportunities in a specific financing source: For example, a

V L = V U + (t × d) − temporary rise in stock price may trigger new equity issue;

PV(costs of financial

distress)

• Market value fluctuations: Because capital structure weights are determined by market values,

these fluctuations may cause the firm’s actual capital structure to vary from the target.