Page 332 - FM Integrated WorkBook STUDENT 2018-19

P. 332

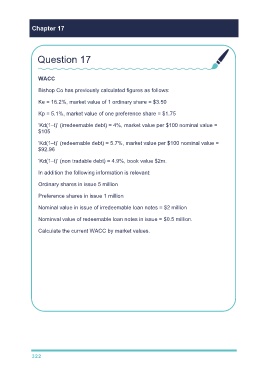

Chapter 17

Question 17

WACC

Bishop Co has previously calculated figures as follows:

Ke = 16.2%, market value of 1 ordinary share = $3.50

Kp = 5.1%, market value of one preference share = $1.75

‘Kd(1–t)’ (irredeemable debt) = 4%, market value per $100 nominal value =

$105

‘Kd(1–t)’ (redeemable debt) = 5.7%, market value per $100 nominal value =

$92.96

‘Kd(1–t)’ (non tradable debt) = 4.9%, book value $2m.

In addition the following information is relevant:

Ordinary shares in issue 5 million

Preference shares in issue 1 million

Nominal value in issue of irredeemable loan notes = $2 million

Nominval value of redeemable loan notes in issue = $0.5 million.

Calculate the current WACC by market values.

WACC by market values:

Market value ordinary shares = 5m × $3.50 = $17.5m

Market value preference shares = 1m × $1.75 = $1.75m

Market value irredeemable debt = $2m/$100 × $105 = $2.1m

Market value redeemable debt = $0.5m/$100 × $92.96 = $0.4648m

Non-tradeable debt use book value = $2m

322