Page 388 - FM Integrated WorkBook STUDENT 2018-19

P. 388

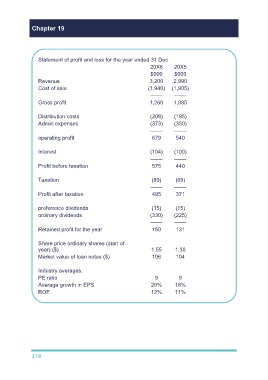

Chapter 19

Statement of profit and loss for the year ended 31 Dec

20X6 20X5

$000 $000

Revenue 3,200 2,990

Cost of sale (1,940) (1,905)

–––– ––––

Gross profit 1,260 1,085

Distribution costs (208) (195)

Admin expenses (373) (350)

–––– ––––

operating profit 679 540

Interest (104) (100)

–––– ––––

Profit before taxation 575 440

Taxation (80) (69)

–––– ––––

Profit after taxation 495 371

preference dividends (15) (15)

ordinary dividends (330) (225)

–––– ––––

Retained profit for the year 150 131

Share price ordinary shares (start of

year) ($) 1.55 1.30

Market value of loan notes ($) 106 104

Industry averages:

PE ratio 9 9

Average growth in EPS 20% 18%

ROE 12% 11%

378