Page 453 - FM Integrated WorkBook STUDENT 2018-19

P. 453

Answers

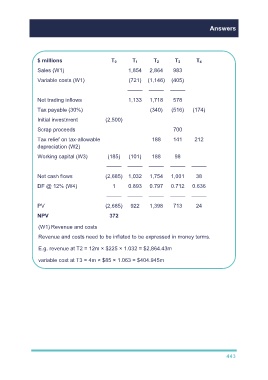

$ millions T 0 T 1 T 2 T 3 T 4

Sales (W1) 1,854 2,864 983

Variable costs (W1) (721) (1,146) (405)

––––– ––––– –––––

Net trading inflows 1,133 1,718 578

Tax payable (30%) (340) (516) (174)

Initial investment (2,500)

Scrap proceeds 700

Tax relief on tax-allowable 188 141 212

depreciation (W2)

Working capital (W3) (185) (101) 188 98

––––– ––––– ––––– ––––– –––––

Net cash flows (2,685) 1,032 1,754 1,001 38

DF @ 12% (W4) 1 0.893 0.797 0.712 0.636

––––– ––––– ––––– ––––– –––––

PV (2,685) 922 1,398 713 24

NPV 372

(W1) Revenue and costs

Revenue and costs need to be inflated to be expressed in money terms.

E.g. revenue at T2 = 12m × $225 × 1.032 = $2,864.43m

variable cost at T3 = 4m × $85 × 1.063 = $404.945m

443