Page 473 - FM Integrated WorkBook STUDENT 2018-19

P. 473

Answers

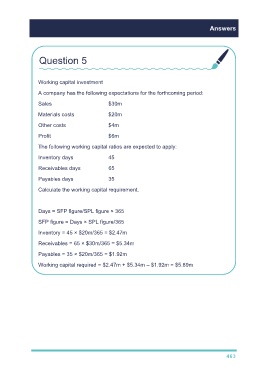

Question 5

365

Working capital investment

A company has the following expectations for the forthcoming period:

Sales $30m

Materials costs $20m

Other costs $4m

Profit $6m

The following working capital ratios are expected to apply:

Inventory days 45

Receivables days 65

Payables days 35

Calculate the working capital requirement.

Days = SFP figure/SPL figure × 365

SFP figure = Days × SPL figure/365

Inventory = 45 × $20m/365 = $2.47m

Receivables = 65 × $30m/365 = $5.34m

Payables = 35 × $20m/365 = $1.92m

Working capital required = $2.47m + $5.34m – $1.92m = $5.89m

463