Page 4 - FINAL CFA SLIDES DECEMBER 2018 DAY 14

P. 4

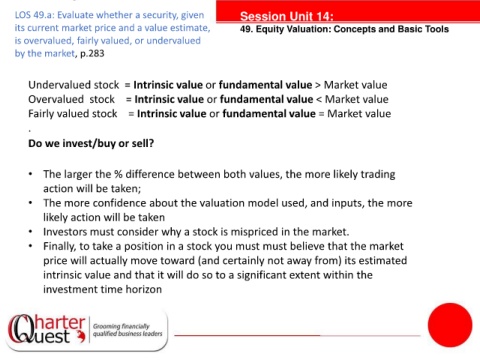

LOS 49.a: Evaluate whether a security, given Session Unit 14:

its current market price and a value estimate, 49. Equity Valuation: Concepts and Basic Tools

is overvalued, fairly valued, or undervalued

by the market, p.283

Undervalued stock = Intrinsic value or fundamental value > Market value

Overvalued stock = Intrinsic value or fundamental value < Market value

Fairly valued stock = Intrinsic value or fundamental value = Market value

.

Do we invest/buy or sell?

tanties

• The larger the % difference between both values, the more likely trading

action will be taken;

• The more confidence about the valuation model used, and inputs, the more

likely action will be taken

• Investors must consider why a stock is mispriced in the market.

• Finally, to take a position in a stock you must must believe that the market

price will actually move toward (and certainly not away from) its estimated

intrinsic value and that it will do so to a significant extent within the

investment time horizon