Page 64 - FINAL CFA SLIDES DECEMBER 2018 DAY 14

P. 64

Session Unit 14:

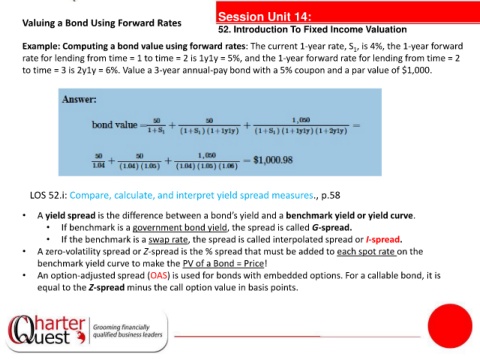

Valuing a Bond Using Forward Rates

52. Introduction To Fixed Income Valuation

Example: Computing a bond value using forward rates: The current 1-year rate, S , is 4%, the 1-year forward

1

rate for lending from time = 1 to time = 2 is 1y1y = 5%, and the 1-year forward rate for lending from time = 2

to time = 3 is 2y1y = 6%. Value a 3-year annual-pay bond with a 5% coupon and a par value of $1,000.

tanties

LOS 52.i: Compare, calculate, and interpret yield spread measures., p.58

• A yield spread is the difference between a bond’s yield and a benchmark yield or yield curve.

• If benchmark is a government bond yield, the spread is called G-spread.

• If the benchmark is a swap rate, the spread is called interpolated spread or I-spread.

• A zero-volatility spread or Z-spread is the % spread that must be added to each spot rate on the

benchmark yield curve to make the PV of a Bond = Price!

• An option-adjusted spread (OAS) is used for bonds with embedded options. For a callable bond, it is

equal to the Z-spread minus the call option value in basis points.