Page 3 - FINAL CFA I SLIDES JUNE 2019 DAY 12

P. 3

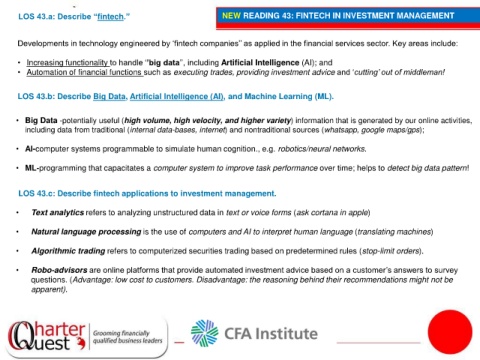

LOS 43.a: Describe “fintech.” NEW READING 43: FINTECH IN INVESTMENT MANAGEMENT

Developments in technology engineered by ‘fintech companies’’ as applied in the financial services sector. Key areas include:

• Increasing functionality to handle ‘’big data’’, including Artificial Intelligence (AI); and

• Automation of financial functions such as executing trades, providing investment advice and ‘cutting’ out of middleman!

LOS 43.b: Describe Big Data, Artificial Intelligence (AI), and Machine Learning (ML).

• Big Data -potentially useful (high volume, high velocity, and higher variety) information that is generated by our online activities,

including data from traditional (internal data-bases, internet) and nontraditional sources (whatsapp, google maps/gps);

• AI-computer systems programmable to simulate human cognition., e.g. robotics/neural networks.

• ML-programming that capacitates a computer system to improve task performance over time; helps to detect big data pattern!

LOS 43.c: Describe fintech applications to investment management.

• Text analytics refers to analyzing unstructured data in text or voice forms (ask cortana in apple)

• Natural language processing is the use of computers and AI to interpret human language (translating machines)

• Algorithmic trading refers to computerized securities trading based on predetermined rules (stop-limit orders).

• Robo-advisors are online platforms that provide automated investment advice based on a customer’s answers to survey

questions. (Advantage: low cost to customers. Disadvantage: the reasoning behind their recommendations might not be

apparent).