Page 66 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 66

Chapter 3

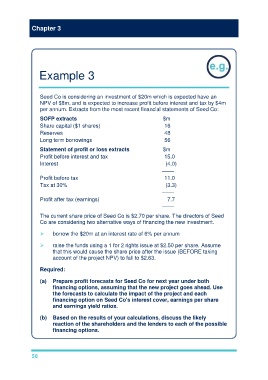

Example 3

Seed Co is considering an investment of $20m which is expected have an

NPV of $8m, and is expected to increase profit before interest and tax by $4m

per annum. Extracts from the most recent financial statements of Seed Co:

SOFP extracts $m

Share capital ($1 shares) 16

Reserves 48

Long term borrowings 56

Statement of profit or loss extracts $m

Profit before interest and tax 15.0

Interest (4.0)

––––

Profit before tax 11.0

Tax at 30% (3.3)

––––

Profit after tax (earnings) 7.7

––––

The current share price of Seed Co is $2.70 per share. The directors of Seed

Co are considering two alternative ways of financing the new investment.

borrow the $20m at an interest rate of 6% per annum

raise the funds using a 1 for 2 rights issue at $2.50 per share. Assume

that this would cause the share price after the issue (BEFORE taking

account of the project NPV) to fall to $2.63.

Required:

(a) Prepare profit forecasts for Seed Co for next year under both

financing options, assuming that the new project goes ahead. Use

the forecasts to calculate the impact of the project and each

financing option on Seed Co's interest cover, earnings per share

and earnings yield ratios.

(b) Based on the results of your calculations, discuss the likely

reaction of the shareholders and the lenders to each of the possible

financing options.

58