Page 95 - Microsoft Word - 00 P1 IW Prelims.docx

P. 95

Leases

Sale and leaseback

4.1 Is the transfer a ‘sale’?

If an entity (the seller-lessee) transfers an asset to another entity (the buyer-lessor)

and then leases it back, both entities must assess whether the transfer should be

accounted for, in substance, as a sale.

Entities must apply IFRS 15 Revenue from Contracts with Customers to decide

whether a performance obligation has been satisfied.

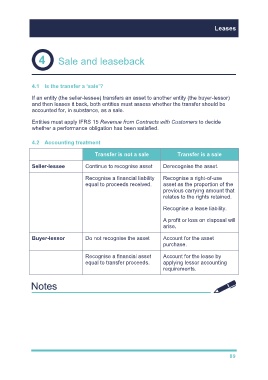

4.2 Accounting treatment

Transfer is not a sale Transfer is a sale

Seller-lessee Continue to recognise asset Derecognise the asset.

Recognise a financial liability Recognise a right-of-use

equal to proceeds received. asset as the proportion of the

previous carrying amount that

relates to the rights retained.

Recognise a lease liability.

A profit or loss on disposal will

arise.

Buyer-lessor Do not recognise the asset Account for the asset

purchase.

Recognise a financial asset Account for the lease by

equal to transfer proceeds. applying lessor accounting

requirements.

89