Page 19 - PowerPoint Presentation

P. 19

ALLOWANCES & CAPITAL GAINS

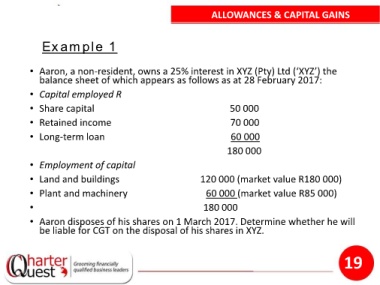

Example 1

• Aaron, a non-resident, owns a 25% interest in XYZ (Pty) Ltd (‘XYZ’) the

balance sheet of which appears as follows as at 28 February 2017:

• Capital employed R

• Share capital 50 000

• Retained income 70 000

• Long-term loan 60 000

180 000

• Employment of capital

• Land and buildings 120 000 (market value R180 000)

• Plant and machinery 60 000 (market value R85 000)

• 180 000

• Aaron disposes of his shares on 1 March 2017. Determine whether he will

be liable for CGT on the disposal of his shares in XYZ.

19