Page 27 - PowerPoint Presentation

P. 27

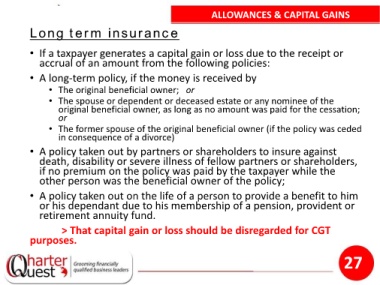

ALLOWANCES & CAPITAL GAINS

Long term insurance

• If a taxpayer generates a capital gain or loss due to the receipt or

accrual of an amount from the following policies:

• A long-term policy, if the money is received by

• The original beneficial owner; or

• The spouse or dependent or deceased estate or any nominee of the

original beneficial owner, as long as no amount was paid for the cessation;

or

• The former spouse of the original beneficial owner (if the policy was ceded

in consequence of a divorce)

• A policy taken out by partners or shareholders to insure against

death, disability or severe illness of fellow partners or shareholders,

if no premium on the policy was paid by the taxpayer while the

other person was the beneficial owner of the policy;

• A policy taken out on the life of a person to provide a benefit to him

or his dependant due to his membership of a pension, provident or

retirement annuity fund.

> That capital gain or loss should be disregarded for CGT

purposes.

27