Page 14 - Test 1 Slides - 1. Introduction & Application Of Legislation

P. 14

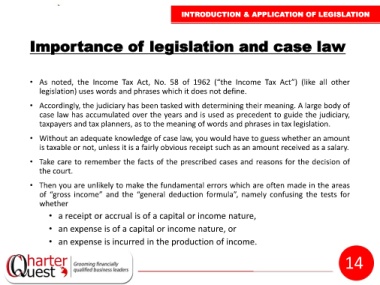

INTRODUCTION & APPLICATION OF LEGISLATION

Importance of legislation and case law

• As noted, the Income Tax Act, No. 58 of 1962 (“the Income Tax Act”) (like all other

legislation) uses words and phrases which it does not define.

• Accordingly, the judiciary has been tasked with determining their meaning. A large body of

case law has accumulated over the years and is used as precedent to guide the judiciary,

taxpayers and tax planners, as to the meaning of words and phrases in tax legislation.

• Without an adequate knowledge of case law, you would have to guess whether an amount

is taxable or not, unless it is a fairly obvious receipt such as an amount received as a salary.

• Take care to remember the facts of the prescribed cases and reasons for the decision of

the court.

• Then you are unlikely to make the fundamental errors which are often made in the areas

of “gross income” and the “general deduction formula”, namely confusing the tests for

whether

• a receipt or accrual is of a capital or income nature,

• an expense is of a capital or income nature, or

• an expense is incurred in the production of income.

14