Page 20 - PowerPoint Presentation

P. 20

INCOME TAXES

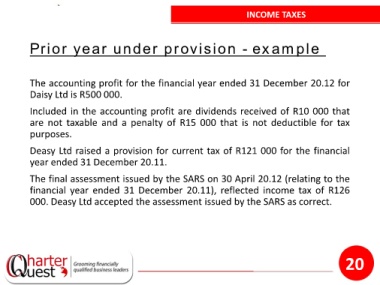

Prior year under provision - example

The accounting profit for the financial year ended 31 December 20.12 for

Daisy Ltd is R500 000.

Included in the accounting profit are dividends received of R10 000 that

are not taxable and a penalty of R15 000 that is not deductible for tax

purposes.

Deasy Ltd raised a provision for current tax of R121 000 for the financial

year ended 31 December 20.11.

The final assessment issued by the SARS on 30 April 20.12 (relating to the

financial year ended 31 December 20.11), reflected income tax of R126

000. Deasy Ltd accepted the assessment issued by the SARS as correct.

20