Page 26 - PowerPoint Presentation

P. 26

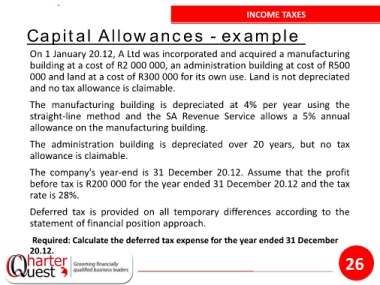

INCOME TAXES

Capital Allowances - example

On 1 January 20.12, A Ltd was incorporated and acquired a manufacturing

building at a cost of R2 000 000, an administration building at cost of R500

000 and land at a cost of R300 000 for its own use. Land is not depreciated

and no tax allowance is claimable.

The manufacturing building is depreciated at 4% per year using the

straight-line method and the SA Revenue Service allows a 5% annual

allowance on the manufacturing building.

The administration building is depreciated over 20 years, but no tax

allowance is claimable.

The company's year-end is 31 December 20.12. Assume that the profit

before tax is R200 000 for the year ended 31 December 20.12 and the tax

rate is 28%.

Deferred tax is provided on all temporary differences according to the

statement of financial position approach.

Required: Calculate the deferred tax expense for the year ended 31 December

20.12.

26