Page 51 - PowerPoint Presentation

P. 51

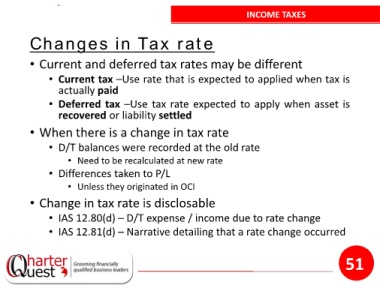

INCOME TAXES

Changes in Tax rate

• Current and deferred tax rates may be different

• Current tax –Use rate that is expected to applied when tax is

actually paid

• Deferred tax –Use tax rate expected to apply when asset is

recovered or liability settled

• When there is a change in tax rate

• D/T balances were recorded at the old rate

• Need to be recalculated at new rate

• Differences taken to P/L

• Unless they originated in OCI

• Change in tax rate is disclosable

• IAS 12.80(d) – D/T expense / income due to rate change

• IAS 12.81(d) – Narrative detailing that a rate change occurred

51