Page 65 - PowerPoint Presentation

P. 65

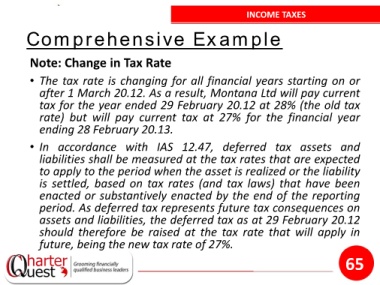

INCOME TAXES

Comprehensive Example

Note: Change in Tax Rate

• The tax rate is changing for all financial years starting on or

after 1 March 20.12. As a result, Montana Ltd will pay current

tax for the year ended 29 February 20.12 at 28% (the old tax

rate) but will pay current tax at 27% for the financial year

ending 28 February 20.13.

• In accordance with IAS 12.47, deferred tax assets and

liabilities shall be measured at the tax rates that are expected

to apply to the period when the asset is realized or the liability

is settled, based on tax rates (and tax laws) that have been

enacted or substantively enacted by the end of the reporting

period. As deferred tax represents future tax consequences on

assets and liabilities, the deferred tax as at 29 February 20.12

should therefore be raised at the tax rate that will apply in

future, being the new tax rate of 27%.

65