Page 18 - PowerPoint Presentation

P. 18

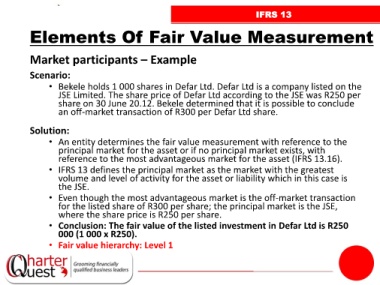

IFRS 13

Elements Of Fair Value Measurement

Market participants – Example

Scenario:

• Bekele holds 1 000 shares in Defar Ltd. Defar Ltd is a company listed on the

JSE Limited. The share price of Defar Ltd according to the JSE was R250 per

share on 30 June 20.12. Bekele determined that it is possible to conclude

an off-market transaction of R300 per Defar Ltd share.

Solution:

• An entity determines the fair value measurement with reference to the

principal market for the asset or if no principal market exists, with

reference to the most advantageous market for the asset (IFRS 13.16).

• IFRS 13 defines the principal market as the market with the greatest

volume and level of activity for the asset or liability which in this case is

the JSE.

• Even though the most advantageous market is the off-market transaction

for the listed share of R300 per share; the principal market is the JSE,

where the share price is R250 per share.

• Conclusion: The fair value of the listed investment in Defar Ltd is R250

000 (1 000 x R250).

• Fair value hierarchy: Level 1