Page 27 - PowerPoint Presentation

P. 27

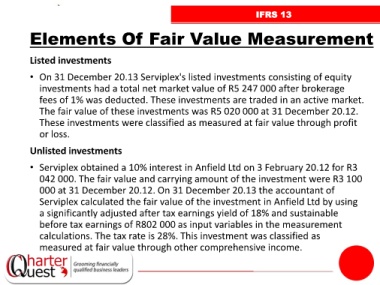

IFRS 13

Elements Of Fair Value Measurement

Listed investments

• On 31 December 20.13 Serviplex's listed investments consisting of equity

investments had a total net market value of R5 247 000 after brokerage

fees of 1% was deducted. These investments are traded in an active market.

The fair value of these investments was R5 020 000 at 31 December 20.12.

These investments were classified as measured at fair value through profit

or loss.

Unlisted investments

• Serviplex obtained a 10% interest in Anfield Ltd on 3 February 20.12 for R3

042 000. The fair value and carrying amount of the investment were R3 100

000 at 31 December 20.12. On 31 December 20.13 the accountant of

Serviplex calculated the fair value of the investment in Anfield Ltd by using

a significantly adjusted after tax earnings yield of 18% and sustainable

before tax earnings of R802 000 as input variables in the measurement

calculations. The tax rate is 28%. This investment was classified as

measured at fair value through other comprehensive income.