Page 29 - CIMA SCS Workbook November 2018 - Day 2 Suggested Solutions

P. 29

CIMA NOVEMBER 2018 – STRATEGIC CASE STUDY

The terms of the swap

The bank’s quoted swap has a two year term, so it will enable Novak to swap its floating rate of

interest for a fixed rate for a two year period. After two years, the rate will revert to (Base Rate

plus 1.40%), so will depend on what the base rate is at that time.

The bank also quotes two swap rates - the bid rate and the offer rate.

The bid rate is the fixed rate that the bank is willing to pay to a client in exchange for receiving the

base rate of interest, while the offer rate is the fixed rate that a client would have to pay to the

bank in exchange for the base rate. The difference between the bid rate and the offer rate gives

the bank’s profit margin.

Novak wants to enter a “pay-fixed, receive-floating” swap, to make sure that its current floating

rate is swapped for a fixed rate. Therefore, only the offer rate is relevant to Novak.

The result of the swap

Novak will enter the swap by paying the offer rate to the bank, and receiving the base rate of

interest in return. Novak’s overall position will be:

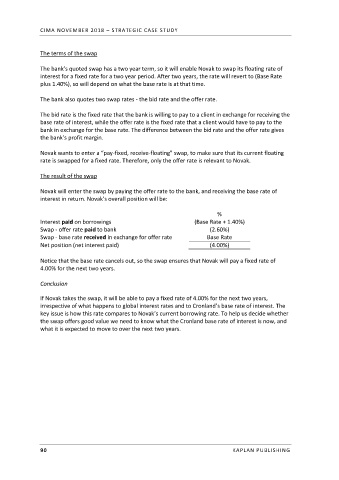

%

Interest paid on borrowings (Base Rate + 1.40%)

Swap - offer rate paid to bank (2.60%)

Swap - base rate received in exchange for offer rate Base Rate

Net position (net interest paid) (4.00%)

Notice that the base rate cancels out, so the swap ensures that Novak will pay a fixed rate of

4.00% for the next two years.

Conclusion

If Novak takes the swap, it will be able to pay a fixed rate of 4.00% for the next two years,

irrespective of what happens to global interest rates and to Cronland’s base rate of interest. The

key issue is how this rate compares to Novak’s current borrowing rate. To help us decide whether

the swap offers good value we need to know what the Cronland base rate of interest is now, and

what it is expected to move to over the next two years.

90 KAPLAN PUBLISHING