Page 21 - FINAL CFA II SLIDES JUNE 2019 DAY 4

P. 21

LOS 12.d: Distinguish between capital deepening investment READING 11: CURRENCY EXCHANGE RATES: UNDERSTANDING EQUILIBRIUM VALUE

and technological progress and explain how each affects

economic growth and labor productivity.

MODULE 12.1: GROWTH FACTORS AND PRODUCTION FUNCTION

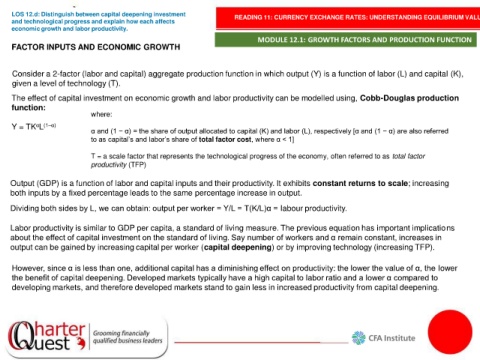

FACTOR INPUTS AND ECONOMIC GROWTH

Consider a 2-factor (labor and capital) aggregate production function in which output (Y) is a function of labor (L) and capital (K),

given a level of technology (T).

The effect of capital investment on economic growth and labor productivity can be modelled using, Cobb-Douglas production

function:

where:

α (1–α)

Y = TK L

α and (1 − α) = the share of output allocated to capital (K) and labor (L), respectively [α and (1 − α) are also referred

to as capital’s and labor’s share of total factor cost, where α < 1]

T = a scale factor that represents the technological progress of the economy, often referred to as total factor

productivity (TFP)

Output (GDP) is a function of labor and capital inputs and their productivity. It exhibits constant returns to scale; increasing

both inputs by a fixed percentage leads to the same percentage increase in output.

Dividing both sides by L, we can obtain: output per worker = Y/L = T(K/L)α = labour productivity.

Labor productivity is similar to GDP per capita, a standard of living measure. The previous equation has important implications

about the effect of capital investment on the standard of living. Say number of workers and α remain constant, increases in

output can be gained by increasing capital per worker (capital deepening) or by improving technology (increasing TFP).

However, since α is less than one, additional capital has a diminishing effect on productivity: the lower the value of α, the lower

the benefit of capital deepening. Developed markets typically have a high capital to labor ratio and a lower α compared to

developing markets, and therefore developed markets stand to gain less in increased productivity from capital deepening.